MICROSOFT DYNAMICS 365 FINANCE ERP

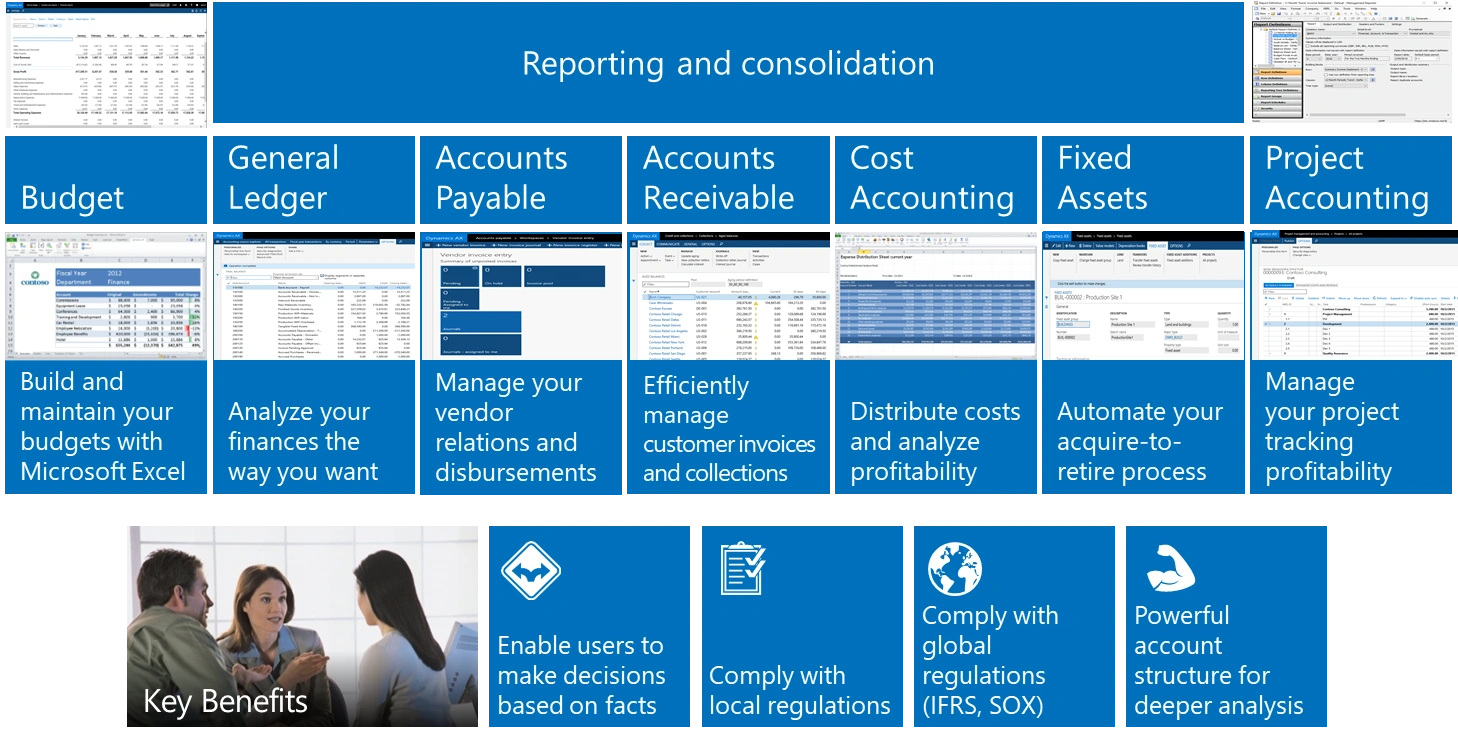

Microsoft Dynamics 365 Finance ERP is a modern business software solution which offers organizations a in-built controls, auditing tools, comprehensive view of their financial data, enabling the management to effectively run its financial and accounting operations. Microsoft Dynamics 365 provides flexible processes with easy to configure workflows. Powerful dashboards and over 800 reports allows you to monitor financial performance, predict future outcomes, and make data-driven decisions to drive business growth.

ERP Accelerate

Our Accelerate toolset built for Microsoft Dynamics 365 Finance ERP helps shorten the implementation timeline, reduce risk and cost.

DETAILED FEATURES of D365 FINANCE ERP

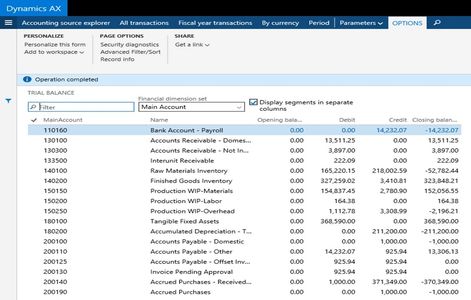

General Ledger with Microsoft Dynamics 365 Finance ERP

Robust General Ledger to define and manage your organizations financial structure and to record transactions

o Multi-Company Support with unlimited legal entities.

o Flexible Accounting Structure with use of Financial Dimensions such as Department, Cost Center, Brand, Product Line, Division.

o Dimension rules that help prevent errors by specifying mandatory dimensions, optional dimensions and also being able to specify configurable ranges.

o Periodic and Recurring accounting journals for repetitive entries such as rent accruals, benefit cost accruals.

o Capability for auto-reversal of transactions.

o Ability to Post Inter-company Transactions via the General Ledger Journal.

o Ability to generate a Trial Balance by any combination of accounts and financial dimensions.

o Allocation Rules to automatically allocate or distribute monetary amounts to one or more accounts or account and dimension combinations based on allocation rules.

o Create cash flow forecasts to anticipate cash requirements and liquidity.

o Flexible year-end closing procedures for any audit adjustments.

Accounts Receivable and Credit & Collections with Microsoft Dynamics 365 Finance ERP

Microsoft Dynamics 365 Finance ERP provides a user-friendly solution for Accounts Receivable and Credit & Collections Management.

o Collections Dashboard to help collections agents focus on overdue payments.

o Apply Full Payment and Partial Payments to Invoices.

o Ability to Import Customer Payments from a Bank Statement and auto-apply to customer invoices.

o Automatic Payment Reminders to Customers.

o Send Customer Statements via email or mail.

o Collection cases to record any disputes raised by a customer.

o Calculate interest and late fees.

o Generate collection letters based on templates for overdue invoices based on age and amount of invoice.

o Accounts Receivable Aging Reports in Microsoft Dynamics 365 Finance.

Accounts Payable with Microsoft Dynamics 365 Finance ERP

Microsoft Dynamics 365 offers extensive functionality for setting managing vendor invoices, vendor claims and supports various vendor payment options.

o Vendor setup with ability to record contact information, financial information, statutory and tax information, diversity information such as minority (MBE), small business (SBE), woman-owned (WBE) etc.

o Create multiple contacts for a vendor.

o Ability to setup Vendor Holds including Payment Hold or Complete Hold.

o Vendor invoice approval process including workflows.

o PO to Invoice matching including two-way and three-way matching with the ability to set up price and quantity variance tolerances.

o Multiple payment methods including check, credit card, wire transfer, Electronic Funds Transfer (“EFT”).

o Support for Positive Pay with integration to Banks to eliminate fraudulent transactions.

o Payment Proposal/ Check run that can be run based on discounts, due dates or a combination of parameters.

Bank and Cash Management with Microsoft Dynamics 365 Finance

Bank Management in Microsoft Dynamics 365 ERP provides capability to create and maintain bank accounts, import bank statements and perform bank reconciliation using matching rules.

o Monitor deposits, payments, drafts, and bank balances; reconcile bank account statements.

o Create entries with interest, penalties and bank fees that are imported in the bank statement.

o Support for electronic payments to vendors. Support for ACH, Wire Transfers, ISO, XML, SEPA, BACS, NETS Payment Methods.

o Positive pay functionality that is used to generate an electronic list of checks and authorized payments and transmitted to the bank to prevent check fraud.

o Import customer receipts into the customer payment journal using a number of standard formats with ability to match imported transactions with invoices using rules.

o Import Bank Statements with native support for common formats such as BAI2 used by major banks.

o Setup matching rules to allow for automatic Bank reconciliation between imported Bank statement and D365 transactions.

Fixed Assets with Microsoft Dynamics 365 Finance ERP

Microsoft Dynamics 365 allows you to manage the full lifecycle of your assets and equipment from acquisition through to retirement and disposal of the asset.

o Fixed Asset Master for Tangible and Intangible Assets.

o Fixed Asset Groups to setup defaults and differentiate. between depreciable and non-depreciable assets e.g. Land.

o Integrated with Procurement to automatically create a new asset or do a fixed asset addition for an existing asset.

o Ability to do Fixed Asset Acquisitions, Asset Additions, Salvage, Sale, Disposal of Assets.

o Tag financial dimensions such as department, cost center, branch for an asset.

o Perform Fixed Asset Transfers.

o Track Insurance policies and policy expiration dates.

o Depreciation simulation to forecast the value of the asset.

o Multiple Depreciation Methods including straight line service life, Reducing balance, Manual, Factor, Consumption, Straight line life remaining, Double Declining Balance (200% reducing balance), 175% reducing balance, 150% reducing balance, 125% reducing balance.

o Multiple depreciation books to support book, tax and GAAP depreciation.

o Multiple depreciation conventions including Half year, Full month, Mid quarter, Mid month (1st of month), Mid month (15th of month), Half year (start of year), Half year (next year)

o Support for bonus depreciation, Section 179 and other statutory requirements in D365 Finance ERP

D365 Finance ERP software licensing

Microsoft Dynamics 365 offers different licensing options and associated access levels for the Finance module. Here's a breakdown of the user licenses and what they typically provide access to:

- Dynamics 365 Finance: Priced at USD 210 per user per month. A full license for accessing the complete range of Finance modules including General Ledger, Accounts Payable, Accounts Receivable, Budgeting, Cash and Bank Management, Fixed Assets, Tax Management, Financial Reporting, Globalization, and Project Management and Accounting, Reporting and Compliance. A Dynamics 365 Finance user license is typically required by finance professionals such as accountants, finance managers, controllers, CFOs, financial analysts, project managers, and tax managers who need access to core financial management functions.

- Dynamics 365 Operations-Activity: Priced at USD 50 per user per month. It provides limited access to financial tasks without granting full access. It covers basic financial tasks including but not limited to creating departmental budgets, approving budget entries, processing payments, reviewing and approving bank reconciliations.

- Dynamics 365 Team Member: Priced at USD 8 per user per month. This license provides limited access to D365 Finance like read only access for viewing financial reports and dashboards. It also provides access to basic functionalities such as entering expenses, or performing invoice approvals.

- Dynamics 365 Attach License: Priced at USD 30 per user per month. This allows additional access to other Dynamics 365 applications when you already have a base license, such as Dynamics 365 Finance. It provides access to complementary modules such as D365 Supply Chain Management, D365 Project Operations, or D365 Human Resources, based on the attach license chosen. The attach license is designed to expand your system without paying for a full license for each additional app.

Videos

MICROSOFT DYNAMICS 365 GENERAL LEDGER

Discover how Microsoft Dynamics 365 General Ledger simplifies financial management with tools for accurate reporting, multi-currency support, budgeting, and seamless integration across your business.

FIXED ASSETS WITH MICROSOFT DYNAMICS 365 FINANCE

Explore how Microsoft Dynamics 365 Fixed Assets simplifies asset management with features like asset master overview, fixed asset acquisition through purchase order, depreciation journal, fixed asset disposal, fixed asset balances and roll forward reports.

ACCOUNTS RECEIVABLE FOR MICROSOFT DYNAMICS 365 FINANCE

Learn how Microsoft Dynamics 365 Accounts Receivable and Collections Management helps you stay on top of your finances with customer master overview, invoicing, payment tracking, and overdue reminders.

Request A QUOTE

Copyright © 2018-2026 Unify Dots. All Rights Reserved.

- Home

- CRM

- ERP

- Ecommerce

- Field Service

- HR

- Project Operations

- MS Dynamics 365 Sales CRM

- D365 Accounts Receivable

- D365 Customer Service

- Product Management

- Supply Chain Management

- Blog

- Contact Us

- Business Analytics

- Loyalty

- Privacy Policy

- Dynamics AX to D365 ERP

- Dynamics ERP Australia

- Professional Services

- Maritime Software

- Agriculture ERP Software

- Manufacturing ERP

- Utility Software

- Consumer Goods Solutions

- Digital Sales Manufacture

- CRM for Banking Software

- MS Dynamics 365 Finance

- MS Dynamics 365 Expense

- D365 Methodology

- D365 CRM Methodology

- Customer Insights

- Making the World Better

- D365 Contract Management

- Winery ERP Dynamics365

- D365 Mobile Order Entry

- Open Positions

- Healthcare with D365

- Copilot AI and Low Code

Cookie Policy

This website uses cookies. By continuing to use this site, you accept our use of cookies.